spot loans reviews

Published August 9, 2023Spot Loans reviews: Exploring the pros and cons of this short-term loan option.

The Pros & Cons of Spot Loans: A Review

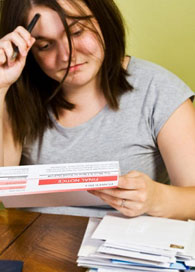

Spot loans are a type of short-term loan designed to provide cash to individuals quickly and conveniently. They are an attractive option for those who need cash fast, but it is important to understand the pros and cons of such a loan before taking one out. This review will provide a comprehensive look at the advantages and disadvantages of Spot loans.

Pros of Spot Loans

The primary benefit of Spot loans is their speed and convenience. Unlike traditional bank loans, Spot loans can be approved in a matter of minutes, and the funds can be deposited in your account as soon as the same day. This makes them ideal for emergency situations or for those who need cash quickly. Additionally, Spot loans are unsecured, meaning you don't have to put up collateral in order to qualify. This makes them a great option for those who don't have the necessary assets to secure a loan.

Another advantage of Spot loans is that they are typically easier to qualify for than traditional loans. The minimum credit score requirements for Spot loans are usually lower than those for other types of loans. This makes them a good option for people with less-than-perfect credit who may not be able to qualify for a traditional loan.

Cons of Spot Loans

The primary disadvantage of Spot loans is the high interest rate. Because they are short-term loans, the interest rate is typically much higher than with a traditional loan. This can lead to high costs over time if the loan is not paid off quickly. Spot loans also typically come with more fees than traditional loans, including origination fees, late fees, and other additional charges. This can quickly add up, so it is important to read the terms of the loan and understand all the associated costs before taking one out.

Finally, Spot loans can be difficult to pay off if your financial situation changes. These loans are typically due in full in a short period of time, and if you are unable to make the payments, you may end up with even more fees and penalties. This can lead to a cycle of debt that can be difficult to break out of.

Conclusion

Spot loans can be a great solution for those who need cash quickly, but it is important to understand the associated risks and costs before taking one out. The high interest rate and associated fees can quickly add up, so it is important to make sure you understand the terms of the loan and are able to make the payments on time. It is also important to be aware of the potential risks of taking out a Spot loan, such as the potential for a cycle of debt.

The Advantages of Spot Loans

Spot loans offer a number of advantages, making them an attractive option for those who need cash quickly. The primary benefit of a Spot loan is its speed and convenience. Unlike traditional bank loans, Spot loans can be approved in a matter of minutes, and the funds can be deposited into your account as soon as the same day. This makes them ideal for emergency situations or for those who need cash quickly.

Spot loans are also unsecured, meaning you don't have to put up collateral in order to qualify. This makes them a great option for those who don't have the necessary assets to secure a loan. Additionally, Spot loans usually have lower credit score requirements than traditional loans, making them a good option for people with less-than-perfect credit.

The Disadvantages of Spot Loans

The primary disadvantage of Spot loans is the high interest rate. Because they are short-term loans, the interest rate is typically much higher than with a traditional loan. This can lead to high costs over time if the loan is not paid off quickly. Spot loans also typically come with more fees than traditional loans, including origination fees, late fees, and other additional charges. This can quickly add up, so it is important to read the terms of the loan and understand all the associated costs before taking one out.

Additionally, Spot loans can be difficult to pay off if your financial situation changes. These loans are typically due in full in a short period of time, and if you are unable to make the payments, you may end up with even more fees and penalties. This can lead to a cycle of debt that can be difficult to break out of.

We use 256 bit SSL technology to encrypt your data.

We use 256 bit SSL technology to encrypt your data.

Spot Loans: Mixed Reviews on Reddit

Find out what Redditors are saying about spot loans. Read honest reviews, ratings, and experiences from real users on Reddit. Make an informed decision before applying for a spot loan. Trust the opinion of the Reddit community for unbiased feedback. ... Read More

Spot Loans 101: Everything You Need to Know

Looking for answers about spot loans? Our comprehensive FAQ covers everything you need to know about spot loans, including eligibility requirements, application process, and repayment options. Discover the benefits and drawbacks of spot loans before making a decision. Trust our expert advice to guide you through the loan process. ... Read More

Decoding Spot Loan Approval Rates - Everything You Need to Know

Get approved for a spot loan with ease and speed! Our quick application process allows for a high approval rate, ensuring you get the funds you need when you need them. Take advantage of our efficient service and secure your spot loan today. ... Read More

Everything You Need to Know About Money Spot Loans

Read unbiased reviews of Money Spot Loans from real customers. Find out if Money Spot Loans is the right choice for your financial needs. Trusted, reliable, and transparent - see what others are saying before making a decision. ... Read More

Spot Loans on Reddit: What Users are Saying

Discover the latest discussions and insights about spot loans on Reddit. Find out what the community has to say about spot loans and how it can help you with your financial needs. Join the conversation now! ... Read More

Spot Loans: Understanding the Basics & the 'Spot Loans Number

Looking for a quick and convenient solution to your financial needs? With Spot Loans, you can get the funds you need in no time. Call our toll-free number now to learn more and start your application process! ... Read More

Spot Loans: Real Reviews and BBB Ratings - What You Need to Know

Looking for unbiased reviews of spot loans? Check out our BBB-accredited company and see what customers are saying about our fast and reliable spot loans. Don't take our word for it, read real reviews from satisfied customers! ... Read More

Spot Loans: Quick Cash for Bad Credit Borrowers

Discover the benefits of spot loans and how they can help you secure immediate funds for unexpected expenses. Learn about the application process, eligibility criteria, and repayment options for this convenient loan option. Find out if spot loans are the right choice for your financial needs. Get all the information you need to make an informed decision today. ... Read More

Spot Loans in Australia: A Quick and Easy Solution for Unexpected Expenses

Get fast access to spot loans in Australia with quick approval and flexible repayment options. Discover your options for emergency or short-term funding today. ... Read More

Spot Loans: Understanding the Limits, Risks & Alternatives

Discover how many spot loans you can have and what factors may affect your eligibility. Protect your finances by understanding the limitations and making informed borrowing decisions. ... Read More